Getting The US News' Best Nevada Mortgage Lenders of 2021 - Loans To Work

Everything about Reverse Mortgage Bank in Reno Nevada Helping Seniors

House owners interested in getting a reverse home mortgage are needed to get compulsory (free) counseling by an independent 3rd party, including a company approved by the Department of Real Estate and Urban Development or a national therapy agency such as AARP. These organizations assist homeowners examine alternative options. "As you age, it gets more difficult to understand a few of the terms in these sort of transactions, so it's not a bad idea to have someone younger who you trust, like an adult child, associated with the procedure," says Phil Cook, a CFP expert in Manhattan Beach, California.

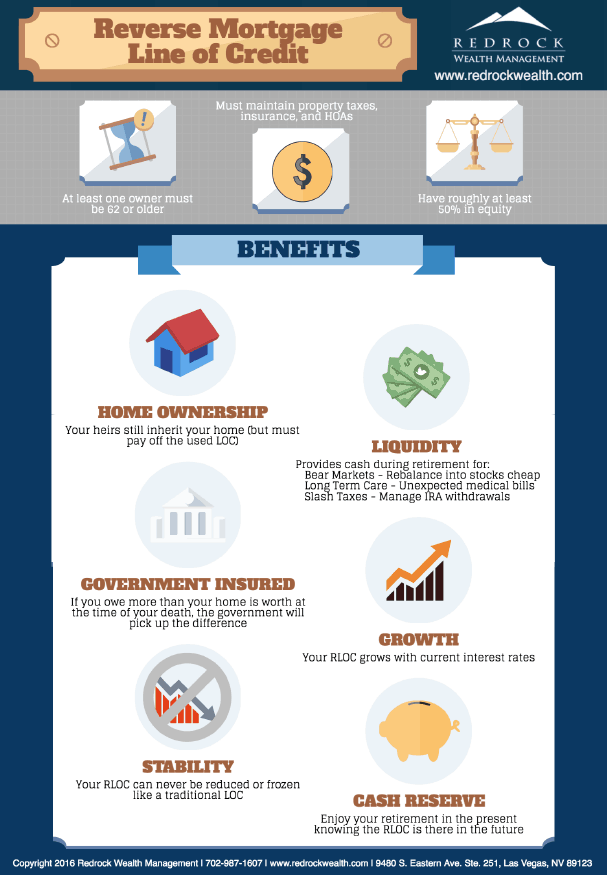

The interest rate you pay is likewise normally greater than that for a standard home mortgage. Anybody who secures a reverse mortgage remains accountable for paying property taxes, insurance coverage and repairs on their home. If you stop working to comply, you may be needed to repay your reverse mortgage early. Investing the equity in your house, of course, also reduces the value of your estate leaving you less to pass along to your successors down the roadway.

The smart Trick of AAG - American Advisors Group - Reverse Mortgage Lender That Nobody is Discussing

"Liquidate your portfolio and reduce your living expenditures. If you still don't have enough, a reverse home loan may make sense." To locate a Federal Real estate Authority-approved loan provider or HUD-approved counseling company, you can go to HUD's online locator or call the Multifamily Real estate Clearinghouse at 1-800-569-4287.

Competitive Home Mortgage Rates & Refinances - Las Vegas Mortgage

An essential component of an effective reverse home mortgage is a trustworthy and knowledgeable loan provider. There are actually lots of certified home loan lenders in Nevada. So how do This Is Noteworthy find them and what do you need to know when you begin out? Nevada FHA Lending Institution Loan Limits High-dollar residential or commercial property is on the rise in Nevada as shown in the county FHA mortgage limits.

Probate & Mortgages - Reed & Mansfield Attorneys

Nevada County Mortgage - Serving All of California

Not known Facts About Probate & Mortgages - Reed & Mansfield Attorneys

The HUD HECM is the primary reverse mortgage in the nation. Over 90% of borrowers have this product. The FHA limits are enough for many typical senior homeowners., from those that are a match to the nationwide average, as well as those set significantly higherup to $200,000 greater. The greatest FHA limitations are found in the Reno-Sparks, Garnerville Ranchos, Las Vegas and Carson City areas.